The first entries for this example are related to cash transactions that shareholders inject into the entity for investment capital. That is the reason why we can see there is a debit to cash and credit to capital. This is so the exact amounts on one side of a journal entry can be determined by subtracting the other side. Continuing from left to right, the next column is the description column. This column details the account titles and an explanation of the transaction that has been made.

Importance of Accurate Entries

It can have the transactions related to Accounts receivables, Accounts payable, Equipment, Accumulated depreciation, Expenses, Interest income and expenses, etc. The dates on the general journal are usually elaborated in a two-column format, with the first column containing the month and the second column containing the year. Several bookkeepers choose to enter the specific day with the description of each entry. That is, if the general journal only covers the transactions of one fiscal year, some bookkeepers may just provide a day and month rather than a month and year. Some transactions do not involve sales, purchases, cash receipts, or cash payments, or are complex to fit conveniently into the general journal.

What is a Journal Entry?

This is why it is also known as the book of original entry, chronological book, or daybook. In this article, we will discuss what a general journal is and show some general journal entries examples. Common examples include adjusting entries, closing entries, and compound entries. Adjusting entries, for example, are crucial at the end of an accounting period to ensure that the financial statements reflect the true financial position of the business.

What is a Sales Journal? Example, Journal Entries, and Explained

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Many of these software provides simple drop downs to record the transactions, thus making complex and tedious tasks very easy.

- For example, it is also known as the book of original entry, the primary book, the book of primary entry, and the book of first entry.

- However, a journal entry with more than one account debited and/or more than one credited is called a Compound Journal Entry.

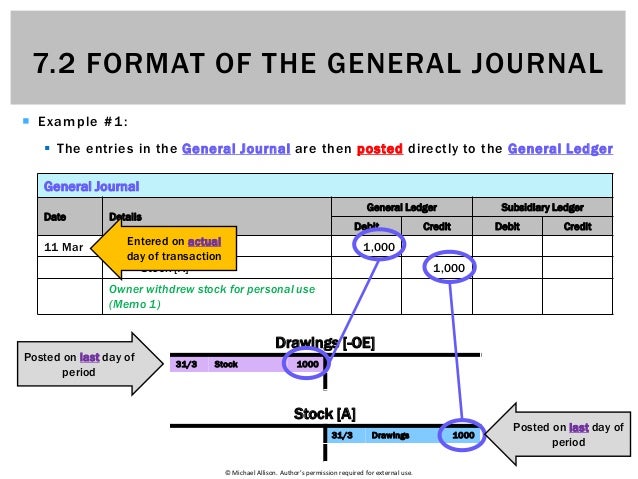

- In summary, we record a transaction into a journal and then post the information in the journal to the respective accounts which are in the general ledger.

- This is similar to the posting process of using a combination journal.

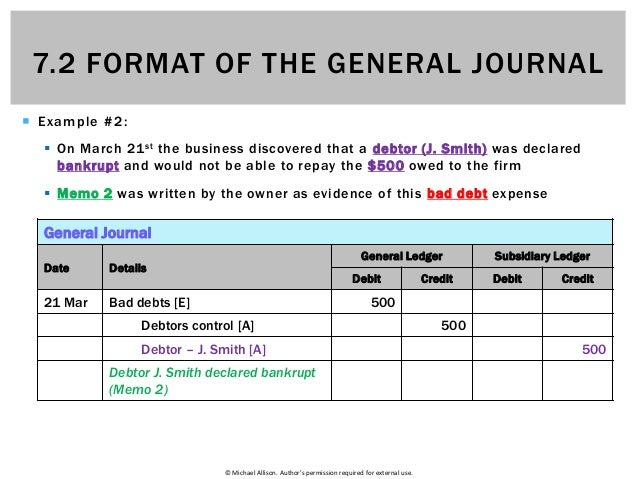

At the end of the year or the end of a reporting period, these transactions are taken from the general journal and posted to individual ledgers. After transactions are recorded in the general journal, they are typically posted to the ledger accounts, which sort transactions by account. This process helps in preparing the trial balance, income statement, and balance sheet. The general journal is an integral part of the accounting cycle and helps ensure that financial statements are accurate and complete. The purpose of an accounting journal is record business transactions and keep a record of all the company’s financial events that take place during the year. An accounting ledger, on the other hand, is a listing of all accounts in the accounting system along with their balances.

Then, at the end of a period, the journals are posted to accounting ledgers for reporting purposes. These examples show how a variety of transactions are recorded in the general journal. Remember, in each case, the total amount debited is equal to the total amount credited, following the rules of double-entry bookkeeping. After these entries are made in the general journal, they would typically be posted to the ledger accounts.

Get in Touch With a Financial Advisor

Transactions that can fit into a more specific categories can be recorded in special accounting journals. After analyzing a business transaction, it is recorded in a book known as the journal (or general journal). When a transaction is logged in the journal, it becomes a journal entry.

This means a new asset must be added to the accounting equation. Sometimes, the general journal is called the book of original entries. This is because all of this book initially records all of the business’s financial transactions before moving into other books. General journals are useful for tracking things like cash at the bank, daily cash receipts, expenses and more. All journal entries are periodically posted to the ledger accounts. In the posting reference column, the page number of the ledger account to which the entry belongs is written.

It is the first place where transactions are recorded according to their dates. Therefore, the general journal is a diary of the business’s transactions. After carrying out a business transaction, it is recorded in a book known as the general journal. The general journal is usually used in the first phase of accounting. It has all original transactions recorded in it, in chronological order.

The journal entry is an essential component of the double-entry bookkeeping system. It is the tool that you’ll always be using to enter the details of the transaction as inputs in the accounting system. Each transaction a company makes throughout the year is recorded in its accounting system.

The above entry is an example of a Simple Journal Entry where the debit and credit entries only involve one account each. However, a journal entry with more than one account debited and/or more than cheap car insurance quotes one credited is called a Compound Journal Entry. A general ledger is a collection of accounts and other items that can be used to track specific kinds and sources of income and expenditures.

We’ve gone through 15 journal entry examples and explained how each are prepared to help you learn the art of recording. Feel free to refer back to the examples above should you encounter similar transactions. Modern accounting software simplifies the process of making journal entries. These tools often automate calculations and provide templates for various types of entries. Utilizing accounting software can reduce errors and save time, making it easier for businesses to manage their financial records.